Almost $40 billion was wiped from the Australian Stock Exchange (ASX) in mere minutes earlier…

Why the Rise and Fall of the Market is Part of Investing

Ted understood that Investing is a great way to create wealth. Thus his investment journey began, and he made modest gains with a stable market. However, a sudden economic downturn caused market volatility, leading to share prices fluctuating and uncertainty gripping the financial landscape.

Even though he knew that no investment comes without risk, Ted’s heart raced as he watched his hard-earned gains erode, leaving him anxious and sleepless.

We’ve all heard such horror stories about creating wealth through investing. It’s because people have no control over market volatility, but believe it or not, there are opportunities in market downturns.

If you believe that investing in shares can give your money the chance to earn better returns than it would if you left it in a bank account, read on. This article will help you with the essential facts you need to know to understand market volatility and how well you can handle it.

Understanding Market Volatility

Market volatility refers to the up-and-down movement of money and assets over a sustained period. It is a statistical measure of how stable or unstable the performance of an investment is based on the market index.

The Australian Securities Exchange (ASX) is a centralised platform for trading shares, bonds, and other financial instruments. Through it, companies that wish to raise capital for expansion or new projects can issue shares to the public, thereby becoming publicly listed entities.

You can then buy and sell these shares on the stock market (aka share market), creating a link between the company’s performance and financial benefits for its shareholders.

SOURCE: https://www.rba.gov.au/publications/rdp/2019/2019-04/australian-equity-market-facts-1917-2019.html

The above Reserve Bank of Australia (RBA) publication shows that the Australian stock market has had ups and downs over the years. Key events, such as the dot-com bubble and the 2008 financial crisis, have significantly impacted the market’s trajectory. Despite these challenges, the market has always rebounded and reached new highs.

Factors that influence Market Fluctuations

The stock market is influenced by various factors, including economic indicators, interest rates, geopolitical events, corporate performance, and investor sentiment. External events like global trade dynamics, political instability, and natural disasters can also impact the market. Understanding these factors and their potential impacts is crucial for you to make informed decisions.

Volatility is normal for investment, as it continues to rise and fall in cycles. You experience gains when conditions are good and prices rise, while negative events can trigger losses when prices fall.

Importance of Market Cycles in Investing

Market cycles are recurring patterns of growth, peak, decline, and trough in the stock market. Understanding these cycles is crucial as it helps determine the optimal times to trade shares. Thus you can manage risk and capitalise on opportunities.

Bull markets, with rising stock prices, promote optimism and confidence, while bear markets, with falling prices, lead to fear and pessimism.

Understanding the importance of market cycles in investing and factors that influence market fluctuations is important, but what’s more important is the psychology of market volatility, i.e., how people react to market fluctuations.

The Psychology of Market Volatility

Market volatility psychology significantly impacts investor behaviour, with emotional reactions like fear and greed causing erratic decision-making and market instability. Recognising and understanding psychological biases can help overcome emotional investing and make more rational choices.

Investor Behaviour During Market Highs and Lows

Market highs and lows are two distinct phases that evoke contrasting emotions in investors. Investors become overconfident and euphoric during bull markets, which breeds herd mentality. This can lead to irrational enthusiasm, creating asset bubbles and increasing market volatility.

In contrast, during bear markets, fear and panic set in, forcing investors to have increased loss aversion and sell shares. The collective urge to sell can increase market drops and a downward spiral, further exacerbating market volatility.

The Impact of Fear and Greed on Investment Decisions

Fear and greed are key emotions that influence investment decisions during market volatility. Fear can lead to hasty selling and greed can fuel an appetite for high-risk investments without adequate analysis. These emotions cloud judgment and can result in significant financial losses.

Fear dominates during extreme market volatility, as investors prioritise capital preservation. On the other hand, greed can take over in bullish markets, causing investors to chase high-flying stocks without considering valuation or long-term prospects.

Common Psychological Biases That Affect Investment Choices

Numerous psychological biases influence investment decisions, often resulting in unsatisfactory consequences.

Confirmation Bias: The tendency to seek information that validates previously held ideas while ignoring contrary data.

Herd Mentality: The tendency to follow the majority’s activities, presuming that they have superior information.

Loss Aversion: The desire to avoid losses over obtaining similar profits, which leads to risk-averse behaviour.

Anchoring Bias: When making decisions, relying too strongly on the initial piece of information received.

Overconfidence: Overestimation of one’s ability to predict and outperform market developments.

Strategies to Overcome Emotional Investing

Although it’s difficult to exclude emotions from financial decisions, certain strategies can help you reduce their impact.

Education and Awareness: Understanding typical psychological biases can make you more aware of your behaviour and decision-making.

Diversification: A well-diversified portfolio, one that invests in multiple asset classes, reduces risk and limits the influence of individual asset performance.

Long-Term Perspective: Focusing on long-term investment goals and fundamentals might help you avoid impulsive judgements based on short-term market fluctuations.

Planning: A well-thought-out investment plan helps reduce impulsive actions during volatile periods.

Professional Advice: Financial advisers can offer objective advice and help you stick to your investment plans.

Building a Resilient Investment Portfolio

Market volatility can be beneficial or disadvantageous for you, depending on your perspective and how you work around the market’s movement.

As volatility increases, the potential for making more money also increases. However, higher volatility increases investment risk. If asset prices drop, it may be a loss for the investor, but it could also be a good buying opportunity for those interested in the asset.

While there is nothing you can do to control the market movement, there are some things you can do to go with its flow.

1. Diversify Your Investments

You have probably heard the saying that you should never put all your eggs in one basket. Doing that for your investment portfolio can help you take better control of your assets. If you have the money, consider spreading it over different types of investments.

That way, when one investment experiences a drop, you should also have other assets that should not be affected by it. These other investments might even rise in value.

Allocate Assets According to Risk Tolerance and Financial Goals

Asset allocation is a strategic approach to determine how to divide your investment capital among different asset classes, such as shares, bonds, real estate, and cash equivalents. The right asset allocation strategy is highly dependent on your risk tolerance and financial goals.

If you have a higher risk tolerance and a longer investment horizon, you may lean towards a more aggressive portfolio, with a higher proportion of equities for potential growth.

Conversely, if you have a lower risk tolerance or are nearing retirement, you may opt for a more conservative approach, with a greater allocation towards bonds or stable income-generating assets.

A resilient investment portfolio should strike a balance between growth and defensive assets.

Growth Assets

Growth assets have the potential for significant returns over time, but they also come with higher volatility.

Shares, also referred to as stocks or equities, signify your partial ownership of a company. As a shareholder after purchasing shares, you stand to earn from the expansion and success of the business. Shares may provide possibilities for long-term growth, pay dividends, and tax benefits, such as franking credits.

You can consult your financial adviser, look for help from a full-service broker, open an online brokerage account, and trade on the Australian Securities Exchange (ASX) to invest in shares.

Property is a growth asset that generally offers higher long-term returns. It’s usually an investment of five years or longer. Property may generate returns through both capital growth and rental income, enabling you to diversify your portfolio of growth assets. However, real estate can also be illiquid, which means that when you need money, it might take some time to sell a home.

Real estate investment trusts (REITs) and managed funds are two indirect ways to engage in real estate besides outright purchasing a property. REITs are publicly traded businesses that own, manage, or provide financing for income-producing real estate properties. They are also known as Australian Real Estate Investment Trusts (A-REITs) or Listed Property Trusts (LPTs). Compared to outright purchases, they might be a more accessible and diversified form of real estate investment.

Defensive Assets

Defensive assets, on the other hand, offer stability and act as a buffer during market downturns. Examples include cash, bonds, and certain alternative investments.

Cash investments consist of cash and savings accounts, certificates of deposit, and high-interest deposit accounts. These are included in a diversified portfolio as a means of wealth preservation and liquidity.

Bonds are debt instruments that are issued by businesses, governments, and other organisations to raise money. When you purchase a bond, you are essentially lending money to the issuer, who promises to reimburse you for your principal plus interest when the bond matures.

Managed Funds and ETFs

Managed funds, indexed funds and exchange-traded funds (ETFs) can either be growth or defensive investments as they offer you packages of investments that you can utilise to create a diversified portfolio that matches your risk appetite.

A managed fund pools the funds of various people to purchase a variety of assets, including shares, bonds, and real estate. When you buy managed fund units, you can diversify your portfolio without needing to purchase individual assets. This can potentially increase yields while also assisting in risk distribution.

Index funds are a category of mutual funds that aims to mimic the performance of a particular market index, such as the ASX 200. Index funds employ fewer fund managers and are relatively cheaper than actively managed funds.

An exchange-traded fund, or ETF, is a form of investment fund that owns a portfolio of shares, bonds, or other assets. It is similar to a managed fund, but unlike a managed fund, it trades on a stock exchange like a share.

Although a fund’s past performance is no indication of its future performance, knowing what companies a fund is invested in will help you pick what suits you best. It may be best to seek the advice of an experienced Financial Adviser when building your investment portfolio.

Portfolio Check and Balance

Portfolio rebalancing is the process of readjusting the asset allocation back to its original target weights due to the skewing of initial asset allocation as market conditions and asset performances change over time.

Portfolio rebalancing ensures that your portfolio remains aligned with your risk tolerance and long-term objectives.

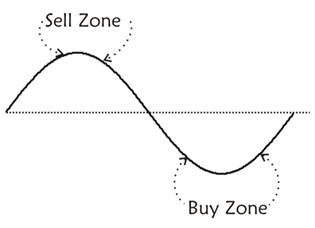

In a bull market, certain assets may outperform others, increasing their portfolio weight. Rebalancing involves selling overperforming assets and reallocating proceeds to underperforming ones. This “buy low, sell high” approach maintains risk level and enforces discipline, preventing emotional decision-making influenced by market euphoria or panic.

2. Look at the Situation From Another Perspective

The rise and fall of the market is inevitable, and it would be too difficult to try to keep an eye on its movement all the time. Let your financial planner take care of the minor details for you. Instead of focusing on these small movements, it would be best to see your investments from a long-term perspective.

While there are constant ups and downs, if you look at your assets in a long-term time frame, you will notice the progress and see how your money continues to grow.

Building wealth is a journey that requires time, commitment, and discipline, and by following these principles, you can unlock the true potential of your financial future.

Significance of a Long-Term Investment Approach

Adopting a long-term investment approach is crucial when you want to build wealth, as financial success is a process that demands patience and perseverance. This mindset allows you to weather short-term market fluctuations and focus on the bigger picture.

Long-term investment strategies enable you to participate in the economy’s growth potential and benefit from market resilience. Don’t focus on timing the market, but rather on your time in the market – a patient approach that can mitigate risk and enhance the potential for long-term gains.

A long-term investment strategy is based on the understanding that financial markets follow cycles and that short-term fluctuations are frequently noise in the big picture.

Long-term investors put more emphasis on the fundamental strength of their investments rather than letting short-term price movements sway them. This strategy allows you to capitalise on the historical growth trajectory of the economy and various industries.

Over the long run, markets tend to appreciate, and businesses typically grow, leading to increased valuations for their share price. By staying invested and weathering market downturns, you can avoid the risk of selling shares at a low price and potentially missing out on the subsequent market recovery.

The Power of Compounding

Compounding is a force that can significantly amplify investment returns over time. At its core, compounding means earning returns on both the original investment (principal) and the returns earned in previous periods. As the investment generates returns, those gains are reinvested, leading to exponential growth.

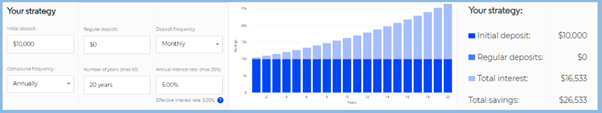

Let’s use a compound interest calculator to demonstrate how this works.

Let’s say you decide to invest $10,000 in a portfolio of diverse equities with an annual interest rate of 5%. You intend to keep these investments for 20 years, reinvesting with all income and capital gains.

Year 1: With an initial investment of $10,000, you make a 5% return and gain $500. Now, the value of your portfolio is $10,500.

Year 2: Your portfolio earns an additional 5% return on the $10,500 increased value during the second year. Your portfolio value rises to $11,025 thanks to a gain of $525 this year.

Year 3: The return of 5% on $11,025 results in a profit of $551. Your holdings are now valued at $11,576 total.

Year 20: Your initial $10,000 investment has grown to about $26,533 after 20 years of compounding at 5% annually. Over the past 20 years, your portfolio has grown by $16,533, and the power of compounding is responsible for a sizable amount of that growth.

Starting early and consistently contributing to an investment portfolio allows you to maximise the benefits of compounding. Even small contributions, when compounded over decades, can result in substantial wealth accumulation. This emphasises the importance of cultivating a habit of regular investing and taking advantage of tax-efficient investment vehicles like retirement accounts, which provide a conducive environment for compounding to work its magic.

Setting realistic Financial Goals and StickING to the Investment Plan

Setting clear and achievable financial goals is the bedrock of a successful investment plan. These goals act as a roadmap, guiding you in making appropriate asset allocation decisions and choosing suitable investment vehicles. Goals can range from short-term objectives like creating an emergency fund to long-term ambitions like funding retirement or leaving a financial legacy for future generations.

Once the goals are established, creating a well-defined investment plan becomes essential. Diversification, asset allocation, and risk tolerance are key considerations in constructing the plan. Regularly reviewing and rebalancing the portfolio ensures that it stays aligned with the desired objectives while accommodating any changes in personal circumstances or market conditions.

Staying committed to the investment plan is equally crucial. Emotional reactions to short-term market movements can lead to counter-productive decisions. Having a disciplined approach and avoiding unnecessary trading can help you focus on long-term growth.

3. See the Opportunity in Every Problem

Market downturns, characterised by falling share prices and economic uncertainty, can be challenging. However, they offer opportunities for long-term investments and potential gains when the market rebounds.

Instead of changing your investment strategy abruptly during unstable times in the market, what you can do is find the opportunity in every problem. When your asset is at its lowest, you could consider investing in it further and wait until it grows back to a higher value again. You should seek the guidance of your financial adviser before proceeding with further investments.

Potential Gains of Market Downturns for Long-Term Investments

Market downturns offer long-term investors the chance to acquire discounted assets, but it’s crucial to differentiate between short-term fluctuations and the fundamental value of quality assets. Overpriced stocks and investments may become more attractive when prices fall, allowing patient investors to accumulate assets with the potential for long-term growth.

Market downturns also force companies to reassess strategies, trim inefficiencies, and adapt to changing economic conditions. Strong, well-managed businesses can emerge stronger from these periods, making them solid long-term investment prospects.

Buying Low and Selling High

During market downturns, you should adopt the “buy low and sell high” approach. Fear often dominates market sentiment, leading to panic selling. This can drive share prices below their intrinsic value, providing a unique opportunity for bargain prices.

Conduct thorough research and identify strong companies with temporary declines due to market conditions. As the market recovers and investor confidence returns, these undervalued assets have the potential for significant appreciation, allowing you to sell high when share prices rebound.

4. Stick with your Comfort Zone

When planning your investment portfolio, it’s important that you only expose yourself to a level of risk that you are comfortable with. Typically, younger people are more comfortable with taking risks and investing in growth assets as they have more time to make up losses; whereas those approaching retirement are more likely to invest in defensive aka lower risk investments to protect the nest egg they have worked so hard to accumulate.

Our rule of thumb is “the sleep factor” – if market volatility and your portfolio are keeping you awake at night then you should consider lowering your risk exposure.

The market is unpredictable, and the only way you can deal with it is to understand and accept that fact. When you learn how to dance to its music, that is the time you can find the best strategy for making money. Of course, working with a professional investment adviser who is experienced in market volatility and structuring robust portfolios could keep your investments healthier than if you go it alone.

Government Policies and Economic Outlook

Government policies and economic indicators play a crucial role in shaping the stock market and investment landscape. As an investor, you must stay informed about the prevailing economic conditions and potential policy changes to make well-informed investment decisions.

Understanding how government actions impact various sectors and asset classes empowers you to navigate the markets effectively and seize opportunities while mitigating risks. As the economic outlook evolves, staying vigilant and adaptable remains the key to successful investing.

Keeping tabs on all of these can be time-consuming and confusing. It may be a good idea to seek professional advice if you get overwhelmed.

Summary

We have explored the vital role of embracing market volatility and have come to understand that market fluctuations are not adversaries to be feared, but rather opportunities to be seized.

By understanding the ebb and flow of the market and using patience and discipline as anchors in the face of uncertainty, we can enable ourselves to weather the storms and capture the full potential of our investments over time. The power of compounding and the exponential growth it facilitates reinforces the significance of staying the course.

As we navigate the ups and downs, it becomes clear that a proactive approach to wealth creation and financial independence is paramount. Diversified investment portfolios act as shields, protecting us from the impact of market shocks, while also providing exposure to various growth opportunities.

Moreover, understanding the influence of government policies and economic indicators on the market empowers us to make informed decisions and adapt to changing circumstances.

In all these, seeking professional financial advice can be a game-changer in achieving your long-term financial goals. With the right financial adviser by your side, you can gain access to expert knowledge, personalised planning, and the emotional discipline necessary to navigate the complexities of the financial world.

Ready to Build an Investment Portfolio?

While investing can seem complicated and time-consuming, it doesn’t have to be that way with knowledge and expert guidance. Whether you’re young or old, it’s never too late to start investing for your future.

Need investment advice? Newcastle Financial Planning Group is to help you tailor your investment plan and build your portfolio. Our financial advice team can help you establish direction for your investments to achieve your financial and lifestyle goals.

Call us or book online to secure your consultation today!

Sources:

- https://www.rba.gov.au/publications/rdp/2019/2019-04/australian-equity-market-facts-1917-2019.html

- https://www.asx.com.au/blog/investor-update/2023/four-emotions-that-can-affect-your-investment-decisions

- https://www.asx.com.au/blog/investor-update/2022/dealing-with-market-volatility-and-losses

- https://moneysmart.gov.au/how-to-invest/diversification

- https://www.ato.gov.au/Forms/Refund-of-franking-credit-instructions-and-application-for-individuals-2022/?page=10#franking_credit

- https://moneysmart.gov.au/how-to-invest/choose-your-investments

- https://www.asx.com.au/investors/start-investing/how-to-buy-and-sell-investments

- https://moneysmart.gov.au/managed-funds-and-etfs/choosing-a-managed-fund

- https://moneysmart.gov.au/managed-funds-and-etfs/exchange-traded-funds-etfs