Retirement planning is a crucial component of financial well-being. It ensures that you can maintain…

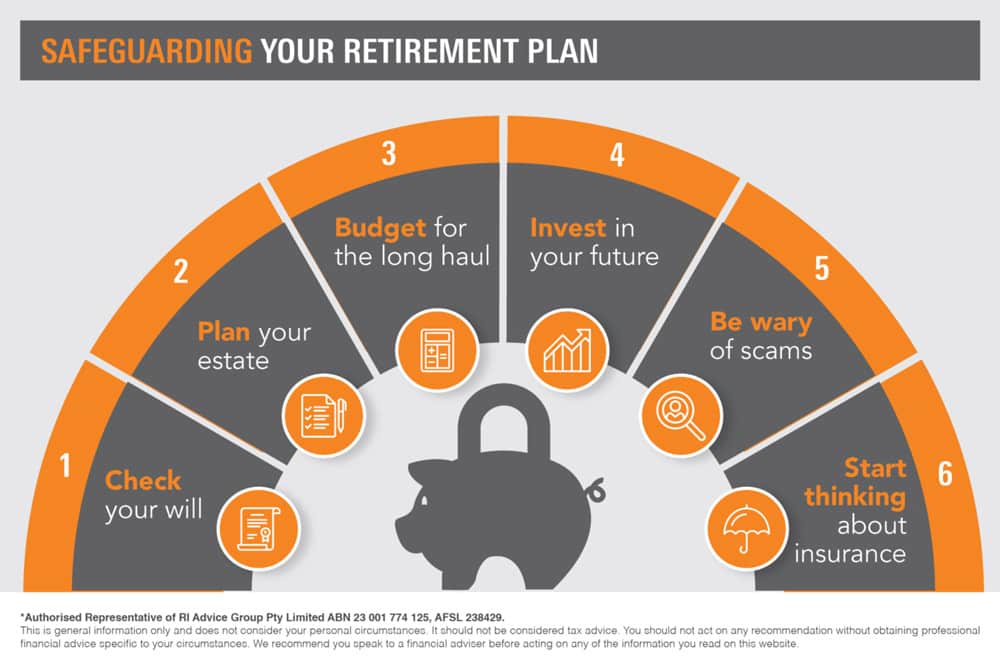

Safeguarding Your Retirement Plan

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some tips to make sure you’ve ticked all the boxes.

1. Check Your Will

Without a valid will, an administrator will be appointed to manage your estate, which may cause your family plenty of problems. To save them the stress, ask a solicitor to draw it up for you and make sure you and two witnesses sign it.

2. Plan Your Estate

Think of your estate plan as your family’s stress-free action plan that they can turn to for guidance when you pass away. It should cover all of your documents, contacts, debts, bills and assets so your family can easily figure out what to do with them.

3. Budget For The Long Haul

Australians are living longer than ever – which means your retirement savings also need to last longer. Create a long-term budget that will help you live the lifestyle you want – and don’t forget about healthcare costs. Then comes the most important part of a budget – sticking to it.

4. Invest In Your Future

From boosting your superannuation to investing in shares, understanding your investment options can make a huge difference to your retirement savings. When you start investing – and you should start early – make sure you have a mix of investments to spread your risk.

5. Be Wary Of Scams

Investment scams are on the rise in Australia, with perpetrators directly targeting retirees to access their superannuation funds. Protect yourself by never giving out your financial details over the phone or by email. And be suspicious of anything that sounds too good to be true.

6. Start Thinking About Insurance

Many insurance policies expire at a certain age, leaving you without cover. And if yours comes from your superannuation fund, it could be eroding your savings. From age-based insurance policies to products that cover funeral expenses, you should seek professional financial advice to develop a plan that is appropriate for you as you enter retirement.

We’re here to help you safeguard your retirement plan. Contact Newcaslte Financial Planning Group today.

Disclaimer: The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429