Author: Bradley Abbott "Pay off your debt first. Freedom from debt is worth more…

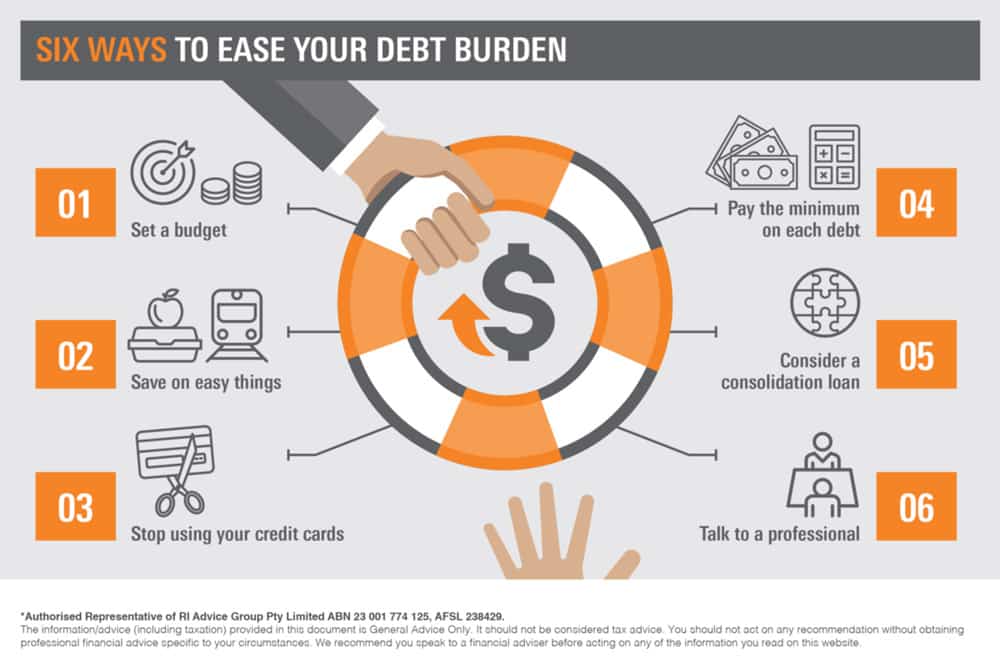

6 Ways To Ease Your Debt Burden

Debt is one of the fixtures of modern life for most people but if you feel it’s getting out of your control, it’s time to act.

Fortunately, there are straightforward ways to regain control of your money.

Start A Debt Management Plan

This will mean prioritising your debts in order of urgency, setting a budget, cutting expenses, consolidating, and planning ahead.

1. Set A Budget

Work out how much you spend each week on your debts and discretionary spending and how much income you have. It’s vital that you are honest. From this you can work out how much you need to service your debts to bring them down to manageable levels.

2. Save On Easy Things

The most obvious way to reduce debt is to cut down your spending on non-essential items. Simple ways include doing things yourself that you previously paid others to do, such as cleaning your house. Eat out less. Cook at home and eat your leftovers at work. Don’t buy things you don’t need at the supermarket and turn off lights and computers when they are not in use. Walk more or take public transport.

3. Stop Using Your Credit Cards

Pay cash. Put your credit cards away. The simple logic is that you won’t be tempted to overspend if you only have cash.

4. Pay The Minimum On Each Debt

Service each debt, be it phone, mortgage or credit card each month. Pay off as much as you can but at least pay the minimum, which will protect your credit score.

5. Consider A Consolidation Loan

You may be able to reduce your interest charges by consolidating your debts into one low-interest loan.

6. Talk To A Professional

Your NFPG Adviser will work with you to develop a debt management plan that’s specifically tailored to you.

But if you are feeling really overwhelmed, seek help from your doctor.

The views expressed in this publication are solely those of the author; they are not reflective or indicative of licensee’s position, and are not to be attributed to the licensee. They cannot be reproduced in any form without the express written consent of the author.

Disclaimer: The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. RI Advice Group Pty Ltd ABN 23 001 774 125 AFSL 238429