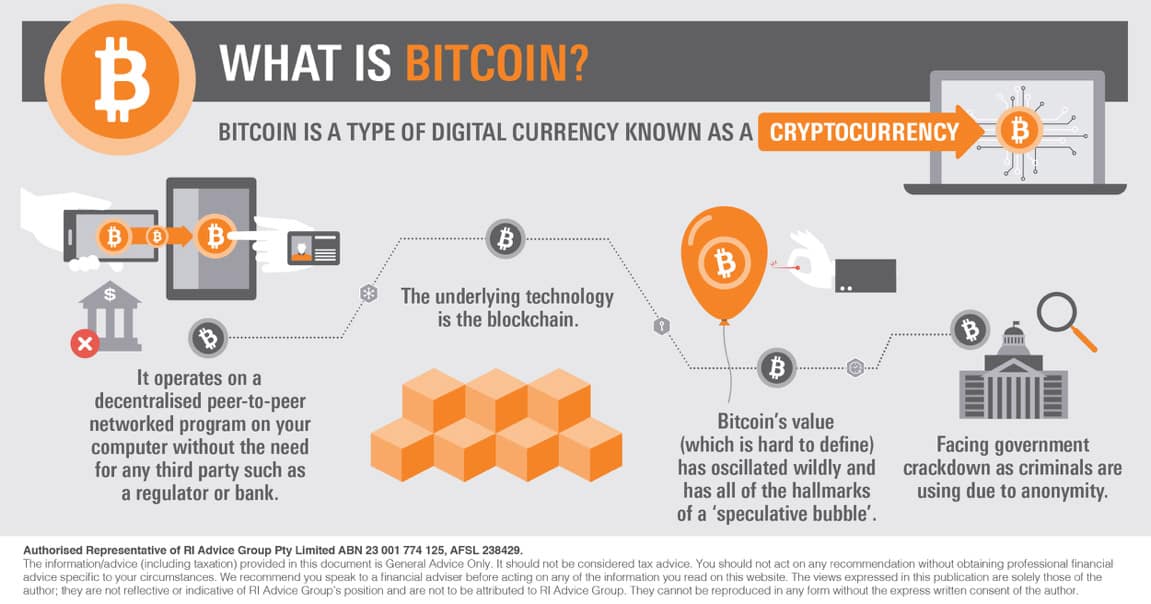

What Is Bitcoin?

Bitcoin is a type of digital currency known as a cryptocurrency. It operates on a decentralised peer-to-peer networked program on your computer, meaning that transactions can be conducted between a buyer and seller without the need for any third party oversight such as a regulator or bank. The underlying technology that makes all cryptocurrencies possible is the blockchain.

Bitcoin’s ‘Wild Run’

Bitcoin’s value has oscillated wildly. It peaked at US$20,000 in mid-December 2017, lost 40 per cent of its value within a week, then bounced back and hasn’t stopped bouncing since.

What Are The Risks?

Bitcoin certainly has all of the hallmarks of a ‘speculative bubble’ and history is littered with plenty of examples of speculative fevers that ultimately collapsed. Another risk is regulation. Some cryptocurrencies are becoming the preferred medium of exchange for criminals due to anonymity, if governments can find a way to crack down they surely will.

Want To Know More?

Have a chat to your financial adviser who can help you work out if Bitcoin, or cryptocurrency, merits further investigation.

Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Financial Services Partners position and are not to be attributed to Financial Services Partners. They cannot be reproduced in any form without the express written consent of the author.

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. Financial Services Partners Pty Ltd ABN 15 089 512 587, AFSL 237590