Life Insurance in Australia is the sort of thing you might know you need, but…

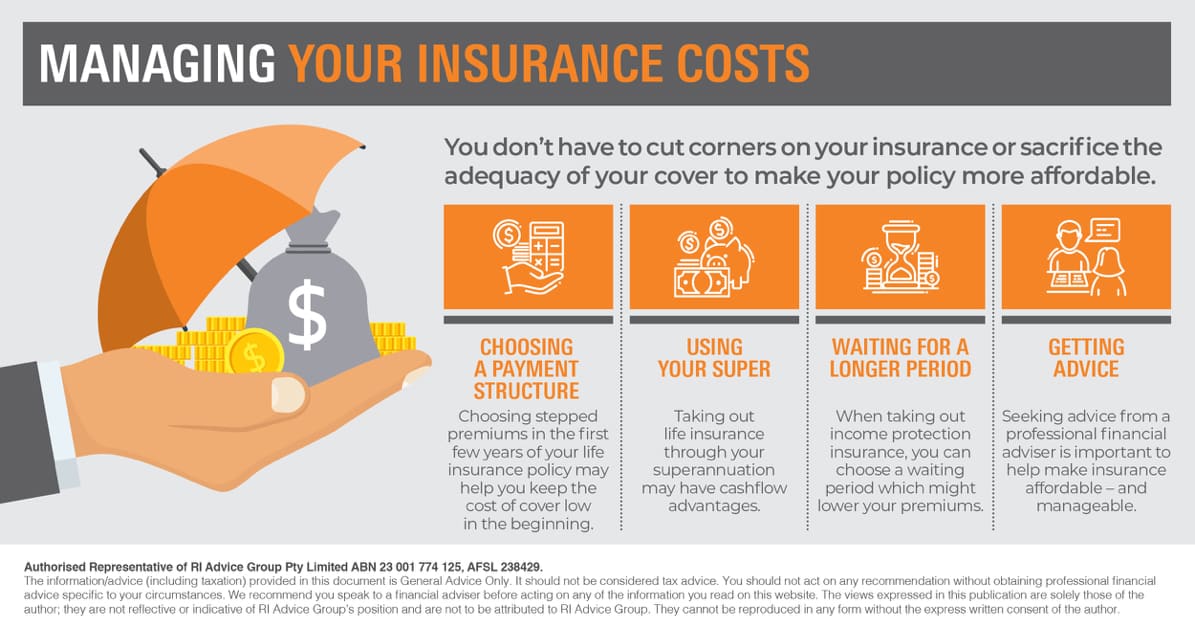

Managing Your Insurance Costs

You don’t have to cut corners on your insurance or sacrifice the adequacy of your cover to make your policy more affordable.

Choosing A Payment Structure

Choosing stepped premiums in the first few years of your life insurance policy may help you keep the cost of cover low in the beginning. Stepped premiums allow you to start paying your insurance at a lower rate, which then rises as you grow older. Your insurer calculates your premiums on each policy anniversary based on your age.

You may consider moving to level premiums as you become more capable of paying your insurance. Although they’re more expensive in the beginning than the stepped structure, level premiums generally offer a good long-term option because premiums are calculated based on your age when you first take out level premiums.

Using Your Super

Taking out life insurance through your superannuation fund may lower the cost of insurance because premiums may be paid using concessionally taxed contributions to your super. Premiums also tend to be cheaper because super funds bulk buy insurance policies and can negotiate discounts.

But keep in mind that super funds may offer limited cover. Talk to your adviser on how to ensure you have enough cover.

Waiting For A Longer Period

When taking out income protection insurance, you can choose a waiting period. The longer you wait before receiving income benefit payments, the lower your premiums.

You can also choose between an indemnity policy and an agreed value policy. Taking out indemnity cover may help you keep the costs down because premiums are generally lower than those for agreed value cover.

Income protection premiums are usually tax deductible if you fund your cover outside super, helping make this policy affordable. If you pay your insurance through your super, premiums are generally tax deductible to the super fund.

Getting Advice

With so much to consider, seeking advice from a professional financial adviser is important to help make insurance affordable – and manageable – for you and your circumstances.

To discuss your in options, call Newcastle Financial Planning Group today to book a meeting with one of our specialist Financial Advisers.

Learn More About Insurance

Contact NFPG To Discuss Your Insurance Options