How Superannuation Retirement Calculators Can Help You

Maximising your superannuation savings is crucial for a comfortable retirement. It helps you maintain your standard of living while keeping up with inflation and the rising cost of living.

Superannuation Retirement Calculators (SRCs) help plan your retirement funds. They estimate retirement income, identify savings deficits, evaluate different scenarios, and set retirement goals. SRCs enable informed decision-making, maximise savings, and help provide retirement security.

This article shows how a superannuation calculator can help maximise your super fund, and discusses the limitations and important considerations to keep in mind when utilising a superannuation calculator for retirement planning.

Understanding Superannuation and Retirement Savings

Superannuation, aka super, is a retirement savings system that involves compulsory contributions made by employers on behalf of employees.

It aims to accumulate savings over an individual’s working life to ensure that individuals have sufficient funds to maintain their lifestyle and cover expenses in retirement. In some cases, it can supplement the government’s Age Pension – when retirees qualify under the means test.

Super contributions are invested to generate returns and are preserved until retirement age, typically between 60 and 65 years. At retirement, individuals can access their superannuation savings as a lump sum, regular income stream, or a combination of both, depending on their preferences and the rules of their specific superannuation fund.

The Australian superannuation system is regulated by the Australian Prudential Regulation Authority (APRA) and the Australian Taxation Office (ATO) to ensure compliance and protect the interests of Australians’ super savings.

Components of Retirement Savings

Understanding the key components of superannuation retirement savings is critical for effective retirement planning. Employer and personal contributions, investment returns, and possible government contributions are among these components. Individuals can maximise their superannuation savings and improve their retirement prospects by optimising these factors.

Employer contributions

Employer contributions, aka Superannuation Guarantee Contributions (SGC), are mandatory contributions made by employers on behalf of their employees towards their superannuation funds.

The current minimum SGC rate is 11% of an employee’s ordinary time earnings (OTE). However, this same contribution fee is scheduled to progressively increase to 12% by 2025.

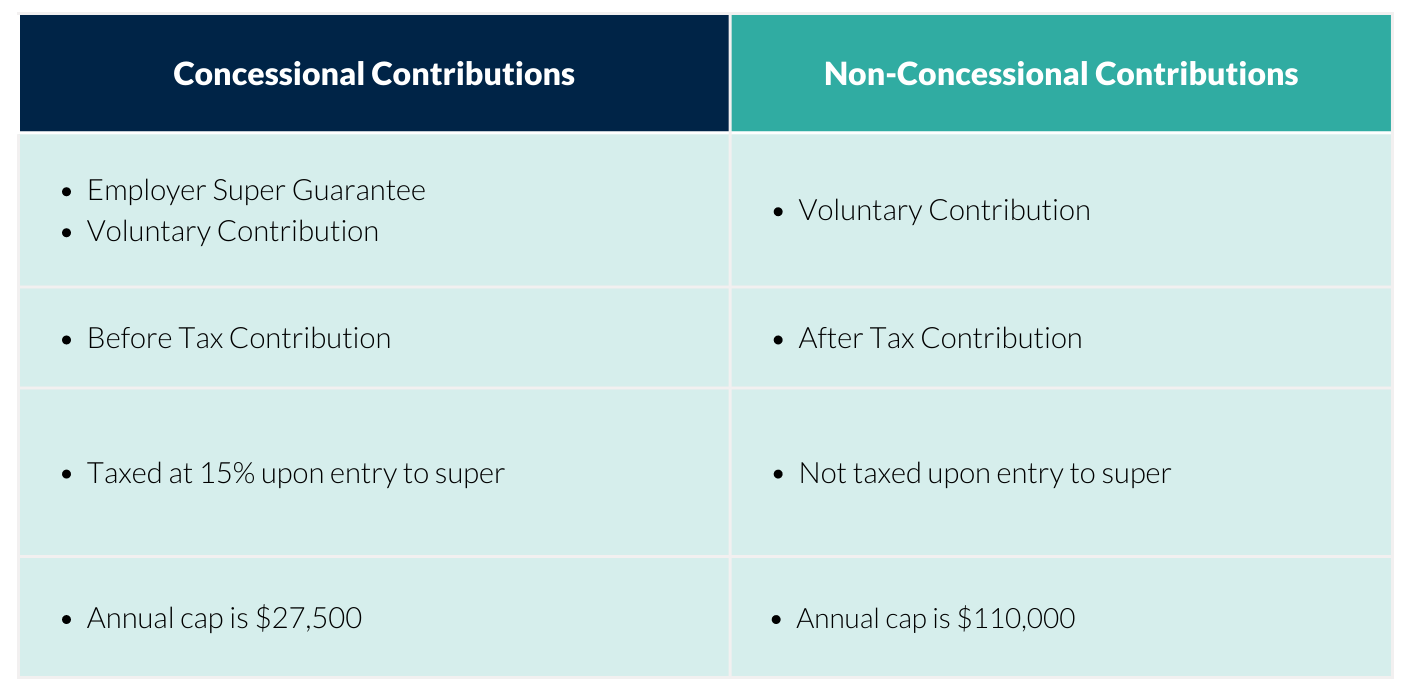

Employer contributions are considered as concessional contributions. Concessional contributions are before-tax contributions. These are contributions made into your super fund before income tax deductions. They are taxed at a rate of 15% in your super fund.

Personal Contributions

Superannuation personal contributions refer to voluntary extra contributions made by individuals into their superannuation fund to supplement their super account. These extra contributions are in addition to the mandatory employer contributions made under the Superannuation Guarantee.

Personal contributions offer individuals the flexibility to boost their super contributions beyond the mandatory employer contributions. It is important to consider personal circumstances, tax implications, and contribution limits when making personal contributions.

Personal concessional contributions are voluntary before-tax contributions made by individuals, which may include salary sacrifice contributions or contributions claimed as a tax deduction. Concessional contributions are subject to a concessional tax rate of 15% when they enter the super fund.

Personal concessional contributions are voluntary before-tax contributions made by individuals, which may include salary sacrifice contributions or contributions claimed as a tax deduction. Concessional contributions are subject to a concessional tax rate of 15% when they enter the super fund.

Personal non-concessional contributions are voluntary contributions made by individuals with after-tax income. Personal after-tax contributions to your super fund may be tax deductible. These are also not taxed upon entry into the super fund, as the income has already been taxed.

There are certain limits and restrictions on personal contributions to your super account. If you exceed your concessional contributions cap or non-concessional contributions cap, you may have to pay extra tax.

The annual concessional contributions cap is currently $27,500, a maximum amount that may change as it is indexed to the average weekly ordinary time earnings (AWOTE). The annual non-concessional contributions cap is currently set at $110,000 and is also indexed to the AWOTE.

Investment Returns

Superannuation funds invest in accumulative contributions to achieve long-term returns. These investments are diversified across various investment assets, such as shares, bonds, real estate, and other investment vehicles.

The performance of these investments has a direct impact on the growth of the super fund. Positive investment earnings can considerably increase the long-term value of retirement funds.

Government Contributions

You can boost your super balance with government co-contributions if eligible. You will get the maximum co-contribution of $500 if your overall income is equal to or less than the lower level and you make personal contributions to your super account totalling $1,000.

If your income is equal to or higher than the higher level, you will not be eligible for a co-contribution.

If your total annual income falls between these ranges, your maximum entitlement will gradually decrease as your total income amount increases. If your share is less than $20, the government will contribute the required minimum of $20.

When you lodge your tax return, the Australian Taxation Office (ATO) will determine your eligibility and pay the government co-contribution automatically to your super account if the super fund has your tax file number (TFN).

When you lodge your tax return, the Australian Taxation Office (ATO) will determine your eligibility and pay the government co-contribution automatically to your super account if the super fund has your tax file number (TFN).

Factors Influencing Retirement Savings

Your super balance at retirement can be significantly influenced by various factors such as contribution amounts and frequency, investment performance, time horizon until retirement, and fees.

Contribution Amounts and Frequency

The amount and frequency of contributions to a super account significantly impact savings. Consistent and frequent additional contributions over time allow for more investment growth, compounding, and a potentially higher retirement income.

Investment Performance

Investment performance is crucial for your super balance. Super funds diversify investment assets in shares, bonds, property, and cash, (for example) and their fluctuating performance affects retirement income. Positive performance enhances savings, while poor performance hinders growth. Investment assets should be evaluated based on risk tolerance, diversification, and thorough research to maximise long-term growth potential.

Time Horizon

The longer the time available for contributions to accumulate and grow, the greater the potential savings. Time provides the opportunity for compounding returns, as investment gains can be reinvested and generate additional earnings. Starting contributions early in your working life gives a significant advantage, while starting later may need higher contributions or alternative strategies to catch up.

Fees and Charges

Fees and charges associated with a super account can impact the final super balance. A super fund would typically charge management fees, administration fees, insurance premiums, and other costs related to investment management.

These fees are deducted from the super balance, reducing the potential growth of your savings. Being aware of fees and comparing options minimises the cost of fees and maximises net returns.

What Are Superannuation Retirement Calculators?

Superannuation retirement calculators are online tools designed to estimate retirement income and savings based on super contributions and investment performance.

Superannuation retirement calculators offer key benefits: estimating future super balances and projected income, assessing progress towards goals, identifying areas for improvement, and analysing different scenarios.

It is crucial to note that because of shifting market conditions, legislative changes, or personal circumstances, actual outcomes may differ from estimates.

Benefits of using Superannuation Retirement Calculators

Super retirement calculators allow you to set realistic goals, make adjustments as necessary, and approach retirement with confidence and security.

Projection of retirement savings based on various parameters

Superannuation retirement calculators can project retirement income and savings based on various parameters. By inputting information such as current age and income, desired retirement age and target income, contribution rate, and expected investment returns, you can get a clear picture of your future financial situation. Thus you can assess if you’re on track to meet your retirement goals.

Analysis of different contribution scenarios

Superannuation retirement calculators allow you to explore the impact of adjusting contribution rates. You can see how increasing or decreasing contributions will affect your super balance by running various scenarios. This information enables you to make well-informed financial decisions and alter your contribution strategy accordingly.

Assessment of retirement income adequacy

Superannuation retirement calculators project not only your super fund balance but also the retirement income you can expect. You can determine whether your predicted retirement income is sufficient to meet your desired retirement lifestyle and its costs by examining elements such as age pension entitlements, annuities, and other income sources.

This assessment assists you in making necessary changes to your savings plan or exploring other income-generating opportunities.

Identification of areas for improvement

Superannuation retirement calculators can help you identify areas for improvement. These calculators can identify any gaps between projected retirement funds and target income. You can take measures to bridge the gap if the calculations indicate a shortfall. This could involve increasing your contribution rate, extending working years, or exploring other investment options. You can make changes to your financial plans and stay on pace to meet your retirement goals if you recognise areas for improvement early on.

Example

Let’s have an example to illustrate what information you need to have on hand when using a super calculator.

John, a 45-year-old professional, plans to retire at 65 and has accumulated $200,000 in his super account. His employer contributes 11% of his annual income of $80,000 and he plans to make additional contributions at 3% of his pre-tax annual income.

John’s superannuation fund generates an average annual return of 6% after fees and taxes. Knowing that his contributions and investment returns are compounded annually he plans to retire with $700,000 in his super.

Using the same example scenario above, let’s see how the MoneySmart superannuation calculator works.

From the known details of John’s super fund, we see that he’ll be $150,000 short of his $700,000 savings goal. The calculator assumes a default figure for fees. John can adjust projections if he has a better understanding of administration fees and what costs may be charged annually.

Based on this result, John has several options:

- Look into other investments in his super fund that have higher potential returns. A higher-risk/higher-return investment mix may be worth looking into if his risk appetite is up to it.

- Consider increasing his supers contribution if he can afford it – this could either be by salary sacrifice or personal non-concessional contributions.

- Delay retirement and extend the timeline to grow his superannuation fund.

- Adjust his retirement lifestyle expectations and reduce projected retirement expenses.

Key Parameters in Superannuation Retirement Calculators

Superannuation retirement calculators have six key parameters that help you understand factors impacting savings and help you make informed decisions. Regularly reviewing and updating these parameters optimises retirement planning and helps ensure a financially secure and fulfilling retirement.

Current age and expected retirement age

Your current age and expected retirement age guide you in determining your saving timeline. It helps estimate remaining years for savings, enabling better planning and goal-setting. It also helps assess progress towards the desired super balance.

Starting early allows for a longer period of saving and investing, allowing you to take advantage of compounding returns and exposure to riskier investment mixes that could yield a higher return. Adjustments to contributions and investment strategies can also be made based on this timeline for sufficient savings.

Current superannuation balance

Your current super balance represents the savings accumulated until the present time and provides a foundation for super fund calculations. A higher current balance indicates a greater foundation to build upon.

Your current super balance serves as a starting point for calculating future contributions and investment growth. By factoring in the current balance, you can estimate the potential growth of your super savings over time.

Knowing your current super balance plays a vital role in formulating retirement savings strategies. Having a higher current balance allows flexibility and more options to achieve retirement goals. On the other hand, having a lower current balance may need more aggressive investment strategies, or an increase in contribution amounts, to make up for the shortfall.

Contribution amounts and frequency

Contribution amounts and frequency directly influence the growth of your super fund and play a significant role in determining financial readiness for retirement.

Higher contribution amounts and consistent contributions enhance the potential for growth through compounding returns leading to a more stable and predictable growth trajectory for the superannuation balance. By factoring in the amount and frequency of contributions, you can estimate the growth of your super fund over time.

A larger super balance, as a result of increased and regular contributions, provides a larger pool of funds from which you can generate retirement income. This in turn can result in a more comfortable retirement lifestyle or reduce the need to rely on other income sources during retirement.

Contribution amounts and frequency also directly influence retirement savings strategies. Individuals who can afford to contribute larger amounts may have more flexibility in their savings strategies. By considering contribution amounts and frequency, individuals can develop savings strategies that are realistic, achievable, and tailored to their specific financial circumstances.

Investment options and assumed returns

The choice of investment assets in a super fund significantly impacts its growth potential. Higher-risk investment assets, like shares, offer greater returns but come with increased volatility, while lower-risk options, like bonds or cash, provide stability but lower returns.

The choice of investment assets in a super fund significantly impacts its growth potential. Higher-risk investment assets, like shares, offer greater returns but come with increased volatility, while lower-risk options, like bonds or cash, provide stability but lower returns.

Assumed returns are estimates of the average annual returns individuals anticipate their investments to generate over time, based on historical data, market analysis, and economic forecasts. They significantly impact superannuation savings growth.

Higher assumed returns indicate a more optimistic outlook for investment performance and potentially higher future savings. However, assumed returns are subject to market volatility and are not guaranteed, thus it’s best to base assumptions on conservative estimates to account for potential fluctuations and mitigate risks.

You can manage risk and diversify your superannuation savings by considering investment options and assumed returns. Diversification involves spreading investments across different asset classes, industries and geographies to reduce market volatility and increase stable long-term returns. Regularly reviewing and adjusting investment allocations is crucial to align with changing financial goals, market conditions, and risk tolerance levels.

Individuals can assess the potential growth of their super fund and align them with their risk tolerance and long-term financial goals by considering available options.

Salary growth projections

The Australian Bureau of Statistics (ABS) quarterly releases a wage price index to view trending salary growth.

Salary growth or wage inflation projections are essential for accurately calculating your future super fund balance, as they provide valuable insights into your income growth over time and impact the amount saved for retirement. They help estimate earning potential and contribution capacity, potentially enabling larger contributions towards the super fund.

Salary growth projections also influence the projected superannuation balance, allowing you to estimate future growth and set realistic retirement savings targets. Additionally, they help determine retirement income needs, assess retirement readiness, and adjust savings strategies accordingly.

Expected retirement income needs

Expected retirement income needs help to determine lifestyle expenses, estimate income gaps, calculate the required super balance, and plan for longevity and inflation. These needs help you calculate the amount needed to generate your desired income during retirement, set realistic savings goals, and guide the development of an effective savings plan.

Expected retirement income needs help to determine lifestyle expenses, estimate income gaps, calculate the required super balance, and plan for longevity and inflation. These needs help you calculate the amount needed to generate your desired income during retirement, set realistic savings goals, and guide the development of an effective savings plan.

Factors such as life expectancy, inflation, and investment earnings also play a role in determining the required super balance. If the estimated retirement income needs exceed your projected balance, you may need to increase savings contributions, adjust investment strategies, or explore other retirement income sources to bridge the gap.

Using Superannuation Retirement Calculators

Retirement planning is crucial in financial management, and superannuation retirement calculators (SRCs) are valuable tools for estimating retirement savings and assessing current strategies. To use these tools effectively, you need to gather accurate information, select a reliable tool, enter the required parameters, and analyse the results carefully.

Gathering accurate and up-to-date information

Gathering accurate and up-to-date information

A crucial step in using SRCs effectively is gathering accurate and up-to-date information.

This includes obtaining superannuation account statements, which provide details about the current balance, investment returns, and any fees or charges associated with the account. These statements offer a starting point for the retirement calculator to make accurate projections.

Additionally, salary details and employment information play a significant role in estimating future income streams during retirement. It is important to provide accurate figures to ensure the calculator generates realistic results.

Selecting a reliable SRC tool

Selecting a reliable SRC tool is the next step in the process. There are various SRC platforms available, and it is advisable to choose a trusted and reputable provider.

When selecting an SRC, the essential factors to consider are user-friendliness, accuracy, and the ability to customise inputs according to individual circumstances. This may include the ability to add insurance premiums, contribution fees, age pension entitlements, and your partner’s super.

Entering the required parameters

Once you’ve chosen a reliable SRC tool, entering the required parameters accurately is crucial.

It involves inputting personal and financial details such as age, current superannuation balance, and expected retirement age. It is important to provide precise information to ensure accurate projections.

Adjusting contribution amounts and frequency is another critical aspect. SRCs allow users to experiment with different contribution scenarios to understand the impact of increased or decreased savings on their future outcomes.

Furthermore, specifying investment options and assumptions regarding future investment returns and inflation rates allows for a more realistic estimation of future super balance.

Analysing the results

After entering the required parameters, it is time to analyse the results provided by the SRC.

The projected retirement savings is a key output that allows individuals to understand the potential size of their nest egg. This figure provides a benchmark against which individuals can compare their desired retirement lifestyle and financial goals.

Additionally, SRCs enable users to compare different scenarios by altering parameters such as retirement age, contribution amounts, and investment options. This comparison allows individuals to make informed decisions about their retirement planning strategies.

Furthermore, SRCs help identify potential shortfalls or excesses in savings. By comparing projected savings with desired retirement goals, individuals can determine whether they are on track or if adjustments need to be made.

If the projected savings fall short of expectations, individuals can explore options such as increasing contributions, extending the retirement age, look to increase income, or seeking professional financial advice. On the other hand, if the projected savings exceed expectations, individuals can consider reducing contributions or exploring additional investment opportunities.

Tips for Maximising Retirement Savings Using SRCs

Superannuation retirement calculators (SRCs) can be invaluable tools in retirement planning, helping individuals assess their savings and make informed decisions. By utilising SRCs effectively, individuals can take proactive steps to maximise their savings.

Increasing contribution amounts

Increasing contribution amounts

Taking full advantage of employer contributions is one of the most effective ways to increase your super fund balance. SRCs can help individuals determine the optimal contribution level to maximise employer contributions. By contributing the maximum allowable amount, individuals can capitalise on the power of compounding and significantly increase their savings.

Note that the maximum superannuation contribution base is $62,270 per quarter. This means that the maximum super guarantee amount an employer is required to contribute is the equivalent of 11% of $62,270 per quarter.

Also, the current super guarantee rate of 11% is the minimum required by law. You may get SGC at a higher rate under an award or agreement.

Beyond employer contributions, making additional personal contributions can further boost your super fund balance. SRCs allow you to assess the impact of increasing your personal contributions and determine the amount that aligns with your financial goals. Even small increments can accumulate over time, making a noticeable difference in the final super balance.

For eligible individuals, government co-contributions can make a difference. SRCs can help individuals understand the eligibility criteria and assess the potential benefits of receiving government co-contributions. By taking advantage of this incentive, individuals can increase their super fund balance without straining their budget.

Optimising investment strategy

SRCs often offer features that allow individuals to assess risk tolerance and explore diversified investment options. By understanding their risk profile, individuals can select investment strategies that align with their comfort level and long-term goals. Diversification across asset classes can help mitigate risk and enhance returns, and SRCs can assist in identifying the optimal asset allocation.

Regularly review and adjust investment options. SRCs provide individuals with tools to evaluate their investment performance, compare various options, and make informed decisions. Optimise your investment strategy and maximise your savings by being proactive and making necessary adjustments based on market conditions and personal circumstances.

Considering salary sacrifice arrangements

Salary sacrifice is a strategy where individuals redirect a portion of their pre-tax income into their superannuation account.

SRCs can illustrate the potential benefits of salary sacrifice, such as reducing taxable income and increasing the balance in your super when you retire. Understanding the mechanics and advantages of salary sacrifice can empower individuals to make well-informed decisions about their contributions.

SRCs allow individuals to simulate different scenarios to assess the impact of salary sacrifice on retirement savings. By adjusting contribution levels and evaluating potential outcomes, individuals can determine the optimal amount to sacrifice from their annual salary. It is crucial to strike a balance that maximises savings while considering other financial obligations and lifestyle needs.

Seeking professional advice

Seeking professional advice from an expert financial adviser can provide valuable insights. SRCs can serve as a starting point for discussions with an adviser, facilitating a more informed and productive conversation. Financial advisers can offer personalised advice and guidance, consider individual circumstances, and suggest tailored strategies to maximise savings.

Retirement planning involves navigating various tax implications. SRCs can help you assess the impact of different strategies on taxable income, tax deductions, and super balance. Financial advisers can provide expertise on tax-efficient strategies, such as utilising concessional contributions or utilising spouse contributions to optimise tax benefits.

Limitations and Considerations

Superannuation retirement calculators (SRCs) provide a convenient way to project your super fund balance when you retire based on default assumptions and inputs. However, it is important to recognize the limitations and considerations associated with using SRCs to ensure accurate and reliable retirement planning. Assumptions and Limitations of SRCs

Assumptions and Limitations of SRCs

It is significant to highlight that SRCs depend on default assumptions for future investment returns, predict the length of retirement using average life expectancies, and take inflation into account by modifying future expenses and income.

Investment Returns

It is challenging to accurately predict the performance of financial markets over long periods. Fluctuations in the economy, geopolitical events, and unforeseen market conditions can significantly impact investment returns. Users should be aware that a projected outcome provided by an SRC is based on a default assumption and may not reflect the actual returns.

Life Expectancy

Individual life spans can vary significantly based on factors such as genetics, lifestyle choices, and access to healthcare. Therefore, relying solely on average life expectancies may lead to inaccurate projections of retirement needs.

Inflation

Some calculators may show results in “today’s dollars” consistent with the present value of the cost of today’s living standards. The accuracy of inflation assumptions is crucial since inflation rates can greatly fluctuate over time. Underestimating inflation can lead to inadequate savings projections, potentially resulting in financial difficulties during retirement.

Considering External Factors

In retirement planning, it’s crucial to be updated with external factors like inflation and legislative changes as these impact superannuation and retirement planning significantly.

Inflation

SRCs often assume a consistent inflation rate, but in reality, inflation can vary significantly over time. It is important to regularly review and update inflation assumptions to ensure the accuracy of super fund projections.

Legislative changes

Legislation governing superannuation and retirement planning can change over time. These changes may include alterations to contribution limits, tax rules, or eligibility criteria. SRCs may not always reflect these changes, and individuals should stay informed about legislative updates that may impact their super fund strategies.

Regularly Reviewing and Updating Retirement Savings Plan

Regularly reviewing and updating the retirement savings plan is crucial to ensure it remains aligned with changing financial circumstances, life events, and market conditions.

Financial circumstances

Factors such as changes in income, expenses, lifestyle, and investment strategies can significantly impact retirement planning. It is essential to regularly review and update the retirement savings plan to ensure it aligns with current financial goals and market conditions.

Life events

Life events such as marriage, divorce, birth of children, or unexpected medical expenses can have a substantial impact on your super contributions. It is crucial to reassess and adjust the retirement plan accordingly to account for these life events and their financial implications.

Monitoring progress

Regularly monitoring the progress of your super fund against the projected goals is necessary to identify any shortfalls or excessive accumulations. Adjustments can be made in savings strategies or investment allocations to stay on track and meet retirement objectives.

Summary

Superannuation Retirement Calculators provide valuable insights into retirement planning, enabling users to assess their financial status, estimate future income, and identify areas for adjustments. They are essential for informed financial decision-making, aligning savings with desired lifestyles. However, retirement planning is a continuous process, and ongoing monitoring and adjustment of savings strategies are crucial for maintaining financial security. Superannuation Retirement Calculators can help by providing real-time calculations and enabling timely adjustments to retirement plans.

Make Super-smart Choices For Your Superannuation with Newcastle Financial Planning Group and Wealth Report!

Superannuation is vital to your financial future in retirement as an Australian. Whatever stage you are right now in your career, learning about how you can make the most out of your long-term retirement savings plan is always a good practice.

At Newcastle Financial Planning Group, we can provide the specialist financial planning, expert knowledge and guidance you need to help you make the right financial decisions for your superannuation strategy so you can look forward to your future with confidence.

Book a meeting with one of our team and enjoy the benefits of Wealth Central – an interactive and real-time platform that provides comparative analysis and financial modelling to enable you to confidently make informed decisions for your future:

- Forecast and interpret the impact of your financial decisions in real-time

- Identify opportunities to grow your wealth

- Seek out threats to your future plans

- Plan your legacy for the next generation

- Understand how the decisions you make today can make for a better tomorrow

Call us or book online to secure your first appointment with us today and get started!

Sources:

- https://www.ato.gov.au/Rates/Key-superannuation-rates-and-thresholds/?=redirected_SuperRate&anchor=Superguaranteepercentage#Superguaranteepercentage

- https://www.ato.gov.au/Individuals/Super/In-detail/Growing-your-super/Super-contributions—too-much-can-mean-extra-tax/?page=3#Concessional_contributions_and_contribution_caps

- https://www.ato.gov.au/Individuals/Super/In-detail/Growing-your-super/Super-contributions—too-much-can-mean-extra-tax/?page=5#Non_concessional_contributions_and_contribution_caps

- https://www.ato.gov.au/Individuals/Super/In-detail/Growing-your-super/Super-co-contribution/?page=2#Eligibility_for_the_super_co_contribution

- https://moneysmart.gov.au/how-super-works/superannuation-calculator

- https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/wage-price-index-australia/latest-release#main-features

- https://www.industrysuper.com/retirement-info/retirement-calculators/retirement-balance-projection/

- https://www.ato.gov.au/Super/APRA-regulated-funds/In-detail/APRA-resources/Protocols/Contributions/?page=2#Employeraward

- https://www.ato.gov.au/Rates/Key-superannuation-rates-and-thresholds/?page=24

- https://www.ato.gov.au/Business/Super-for-employers/Paying-super-contributions/How-much-super-to-pay/#Workouthowmuchtopay1