A Federal Budget Update 2018/19 The announcements in this update are proposals unless stated otherwise.…

I Am Trying To Build My Wealth – How Will The Federal Budget Affect Me?

A Federal Budget Update 2018/19

The announcements in this update are proposals unless stated otherwise. These proposals need to successfully pass through Parliament before becoming law and may be subject to change during this process.

What You Need To Know

- The Budget is forecast to return to surplus in 2019/20 with a positive balance of $2.2bn

- Income tax relief for low-income and middle-income earners – up to $530 per annum via a tax offset– for four years commencing 1 July 2018

- Addressed income tax bracket creep – as part of a seven-year plan to ultimately eliminate the 37% tax bracket

- A major crack down on tax cheats and the black economy

- The Medicare Levy will not be increased to 2.5% as proposed in the 2017/18 Federal Budget, instead it stays at 2%

- Superannuation – exit fees banned, a 3% passive fee cap for accounts with balances less than $6,000 and a voluntary contribution work test exemption for the financial year following the financial year people aged from 65 to 74 retire whose balance is less than $300,000

- Child care – more than 85% of families will receive the full Child Care Subsidy from 2 July when the threshold increases to a combined income of $187,000 p.a.

- Aged care – seniors will be encouraged to continue living at home rather than going into care with the help of $1.6bn allocated to providing 14,000 home care places over the next four years

- Education – schools to receive an extra $24.5bn over 10 years to fund needs-based education – an average increase of 50% per student

- Infrastructure – major spending on rail and road including a $1bn Urban Congestion Fund to improve traffic flow

- Energy costs – estimated to reduce by $400 per year on average for every Australian household from 2020, courtesy of the National Energy Guarantee

- National security – $293.6m to be spent on aviation security including upgraded screening at 64 regional airports.

Overview

The economic plan delivered by Treasurer Scott Morrison on Tuesday 8 May is centred on tax:

- Providing tax relief to low-income and middle-income earners

- Addressing bracket creep with a seven-year plan that will see the 37% tax bracket disappear entirely

- Maintaining the Medicare Levy at 2%

- Cracking down on tax cheats and the black economy.

Tax Relief And Radical Reform

The tax relief promised by the tax offset will take effect from 1 July 2018.

- People earning up to $37,000 will receive a tax offset of up to $200

- People earning up to $90,000 will receive up to $530

- People earning from $90,000 to $125,333 will receive an offset that tapers to nil.

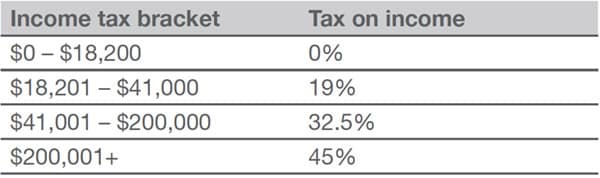

The radical plan to eliminate the middle tax bracket of 37% is a long way off, both chronologically and politically – 7 years and two elections. All going well, it will be implemented in three phases culminating in a tax scale that, from 1 July 2024, will be as shown below.

Medicare And Health

In the 2017/18 Federal Budget, the Government proposed a substantial increase from 2% to 2.5% to help fund the National Disability Insurance Scheme (NDIS). This would have added the average family approximately $600 extra per year.* The Treasurer announced that this will no longer be necessary; instead the Medicare Levy will stay at 2%.

The Budget also includes an agreement that will see public hospitals receive over $30bn in extra funding between 2020/21 and 2024/25.

*The Daily Telegraph 8 May 2018

Crackdown On Welfare Cheats, Tax Cheats, And The Black Economy

The Government aims to save $229m over three years by intensifying its fraud detection and debt recovery. To stamp out money laundering and tax evasion, from 1 July 2019, cash payments over $10,000 will be illegal and they will have to be made by electronic transfer or cheque instead.

Superannuation Changes

New Fee Rules From 1 July 2019

Exit fees on all superannuation accounts will be banned, presenting the opportunity to review your current super fund and, if appropriate, switch without penalty.

Also, funds on accounts with balances below $6,000 there will be a 3% annual cap on passive fees charged by superannuation funds.

Reuniting Lost Super Accounts

The package includes consolidation measures to transfer all inactive super accounts with balances below $6,000 to the ATO and for the ATO to reunite these accounts (along with accounts currently held by the ATO) with the member’s active account where possible.

Insurance In Superannuation

The Government’s ‘Protecting Your Super Package’ includes changes for insurance within superannuation to move from an opt-out basis to opt-in, for members who:

- have balances of less than $6,000;

- are under the age of 25 years;

- have an account that has not received a contribution in 13 months and are inactive.

These changes are intended to protect retirement savings from the costs of having premiums for unnecessary or duplicate insurance cover. The measures are proposed to start from 1 July 2019 and affected members will have 14 months to decide whether to opt-in to their existing cover or allow it to cease.

Your financial adviser can help you identify the appropriate options for you to protect the people who depend on you.

Increasing SMSF Maximum Membership From Four To Six

Effective 1 July 2019, the increased maximum of six may be welcome news to large families. However, adding members to an SMSF is a decision that warrants careful consideration and professional advice.

Do You Own Vacant Land?

From 1 July 2019, deductions for expenses associated with holding vacant land (residential or commercial) will be denied. Denied deductions cannot be carried forward for use in later income years and cannot be included in the cost base if they would not ordinarily form part of the cost base.

This measure will not apply to expenses incurred after:

- A property has been constructed on the land, it has received approval to be occupied and is available for rent, or

- The land is being used by the owner to carry on a business (including primary production).

What’s Next?

Most changes must be legislated and passed through Parliament before they apply. If you think you may be impacted by some of the Budget’s proposed changes, you should consider seeking professional advice. A financial adviser can give you a clear understanding of where you stand and how you can manage your cash flow, super and investments in light of the proposed changes.

If any of these proposals raise questions, concerns or new opportunities for you, contact Newcastle financial planning group today.