Managing your finances should always be done as early as possible, whether you're a student,…

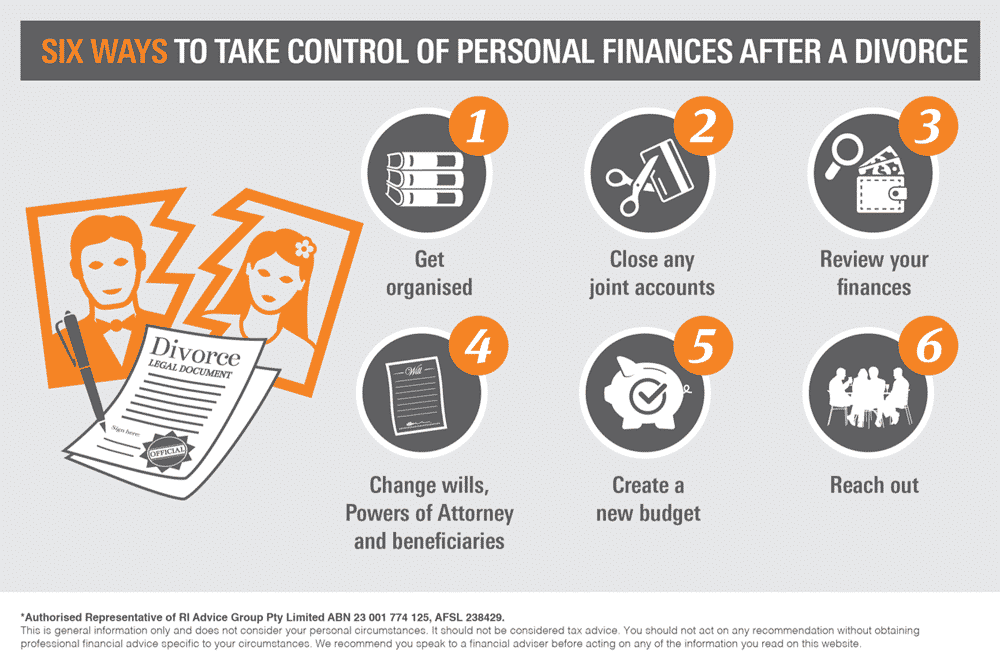

Six Ways To Take Control Of Personal Finances After A Divorce

The key to managing finances after a divorce is getting organised early. Read this guide for tips on taking control at the right time.

Divorce can be one of the most financially stressful experiences of an individual’s life. The key to taking control is to get organised early. Acting quickly to organise accounts, update details and make financial plans may help those in the process of divorce or about to be divorced start the next phase of their life with more peace of mind. The following six steps are a good place to start.

1. Get Organised

It’s important to keep track of key dates, such as when the separation occurred. It’s also a good idea to inform the post office if one party moves out, so they can continue receiving mail at the new address. Next, both parties should gather all financial information, making sure there are copies of all documents. They should also write a list of all financial and property assets, liabilities and policies, making a note of whose name each document is registered under. These may include:

- Bank, brokerage or investment accounts

- Credit cards

- Vehicle registration

- Life, health, home, car and other insurance policies

- Utility bills for electricity, gas, internet and phone

- Property documents such as deeds, mortgage papers and home loan details

- Recent tax returns and tax file numbers

- Superannuation account details

- Will and estate plans

- Rental agreements or leases.

2. Close Any Joint Accounts

As soon as possible, it’s important to close accounts or credit cards that are in both parties’ names, and cancel any redraw facilities. This will protect the finances of each individual and ensure no more debt accumulates. Each party can then open an account in their own name, which only they can access. They will also need to redirect any income that previously entered a shared account into this new account.

3. Review Your Finances

The parties will need to update any remaining accounts, loans or policies so they are registered in just one individual’s name.

Insurance

It’s crucial to update insurance policies as any individual not named will not be covered. This individual will need to make sure that they have other cover in place that is adequate and affordable for their needs. Also, remember to update any nominated beneficiaries on new or existing policies.

Loans

The person whose name is on a loan agreement is responsible for any debt, regardless of changed personal circumstances. It’s vital for the necessary party to remove their name or for both individuals to pay off the loan.

Superannuation

Superannuation is a significant financial asset. Any nominated beneficiaries of the parties’ retirement nest eggs will need to be updated.

Rent and Utilities

4. Change Wills, Powers of Attorney and Beneficiaries

Many Australians don’t realise that divorce can affect their will. Different states have different laws. In Western Australia, for example, divorce automatically revokes the current will. It is vital to update wills to reflect new circumstances as soon as possible.

To be valid, a will needs to be signed by two witnesses. Drawing up a will can be complex so it may be best to consult a solicitor or trustee.

5. Create a New Budget

It can take time to adjust to relying on only one income. Creating a budget and financial plan early on can make it easier to track expenses and feel confident that bills and payments will be covered.

6. Reach Out

Divorce can be a very difficult time. There are many online government resources, as well as legal aid services, counsellors and financial advisers that can provide helpful advice on how to make the process as painless as possible. Getting in touch with nearby support services is the best way to get a helping hand.

Contact NFPG to arrange a consultation.