Authors: Daniel Brown and Ryan Bultitude Reflecting on a common occurrence with new clients…

Taking Control Of Your Cashflow And Setting Your Budget

How To Budget

Gaining an understanding and control over your cashflow is the first step on any financial journey. With a suitable strategy and a bit of discipline, budgeting can help you get you to where you want to be and keep you on track to reach your goals. To help you get started, Newcastle Financial Planning Group has created the following guide for you to follow.

Step 1: Determine Your Net Income

Don’t make the mistake of thinking you have your whole salary to spend. You need to calculate your net income, that is, your income after deductions and tax.

Step 2: Categorize Your Spending

Categories your expenses into fixed and variable expenses. For example:

- Fixed expenses are items such as rent and loan repayments.

- Variable expenses are items that vary month to month such as groceries and fuel for the car.

Then, categories those expenses into ‘needs’ and ‘wants’. For example:

- Fuel for the car to drive to work, is a need to have.

- Subscription to a magazine, is a want to have.

This enables you to effectively scrutinise your spending and assess your current financial position pre-budget.

ASIC’s Money Smart Budget Planner Tool, may be useful at this stage of planning.

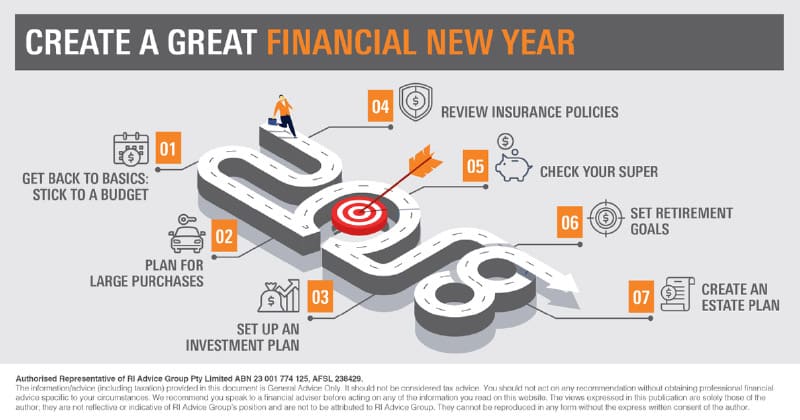

Step 3: Set Your Goals

Make a list of all your short-term and long-term financial goals:

Short-term goals are achieved within a year such as an overseas holiday.

Long-term goals take longer such as saving for a house deposit or preparing for retirement.

Setting goals is important as it provides something to aim for, track your progress and keep you motivated.

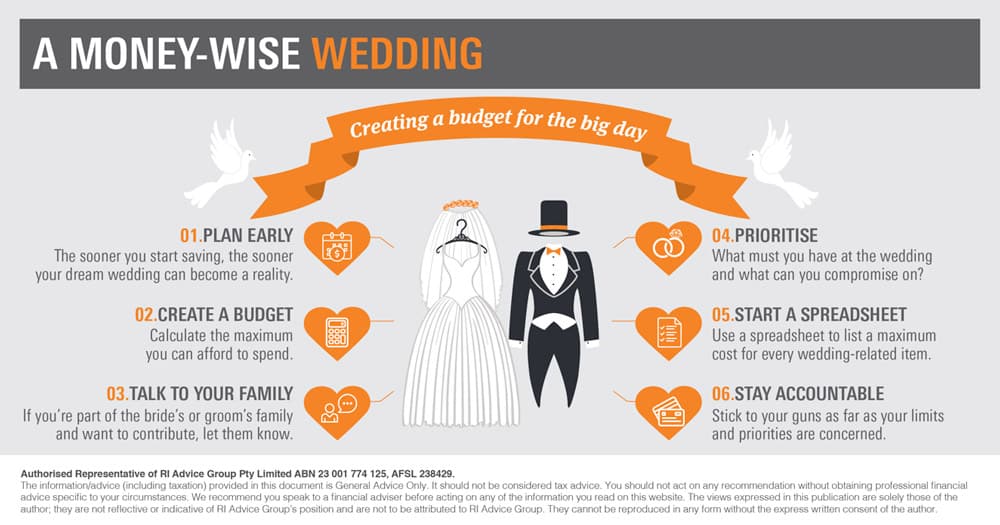

Step 4: Priorities Your Spending

Create a spending plan by putting your expenses in order of priority.

Your ‘needs’ expenses have priority; however, they can be reduced to increase cashflow. Fixed expenses could be reduced by perhaps refinancing the mortgage or moving to house with cheaper rent. Variable expenses are easier to reduce, for example, buy groceries at Aldi rather than Woolworths or shop around for a cheaper electricity/gas provider.

If you’re serious about achieving your financial goals, they will take priority over your ‘wants’ i.e. unnecessary expenses. You don’t have to give up making purchases and enjoying life. Instead, look at how you can make small substitutions to meet budget, such as watching a movie at home rather than at the cinema.

Once you have created a hierarchy for your expenses, you can then allocate your funds to them, i.e. set your budget.

Step 5: Review Your Budget

Your budget is a guide only so expect fluctuations in expenses to affect your budget occasionally. You may find that some budget items were unrealistic and need to be increased, alternatively surplus cashflow may create opportunities to save more. If it is the case, make the appropriate changes to your budget as you progress.

An app such as ASIC’s Money Smart TrackMySPEND can help you to monitor your cashflow and track your budget’s progress.

Step 6: Enjoy Reaching Your Goals

Finally, remember to celebrate the milestones of your budget journey. If you reach a savings goal, treat yourself to something small. If it’s a bigger goal, make sure to enjoy your success, after all, you did all the hard work!

If you require support with your cashflow and budget, please contact your trusted team of local financial planners at Newcastle Financial Planning Group on 02 4032 7934 to receive support and identify a suitable strategy to guide you in the right direction.

Learn More About Budgeting and Cashflow

Contact NFPG To Learn More

DJIB Investments Pty Ltd T/A Newcastle Financial Planning Group is a Corporate Authorised Representative of RI Advice Group Pty Ltd, ABN 23 001 774 125 AFSL 238429. This editorial does not consider your personal circumstances and is general advice only. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. The views expressed in this publication are solely those of the author; they are not reflective or indicative of Licensee’s position, and are not to be attributed to the Licensee. They cannot be reproduced in any form without the express written consent of the author.